You may well be familiar with the term ROAS, but you’re probably not when it comes to Blended ROAS. Blended ROAS is the total revenue earned for every dollar spent on ads across all sales channels, unlike ROAS that takes into account the revenue and ad spend from a single channel.

If you’re marketing a DTC(Direct To Consumer)-oriented brand, utilizing blended ROAS as your KPI could help you understand how your ad campaign affects the overall growth in multiple channels. Also, understanding the overall system across different channels will allow you to make organizational changes through collaborating with other teams.

Why Blended ROAS, instead of ROAS?

Why Blended ROAS, instead of ROAS?

In order to understand why marketers focus on blended ROAS, we must discuss the iOS 14.5 update in 2021. This update was a significant shock to the ad industry, primarily due to the ATT (App Tracking Transparency) feature. After the update, the accuracy of targeted ads decreased, making it difficult for marketers to trust the conversion data provided by ad channels. Marketers had to rely on their experience and other attribution tools such as Google Analytics and Amplitude as supplementary tools. Without data from users who opted out, ad channels began to undervalue ROAS. However, this shift allowed us to focus more on profit by comparing and contrasting total revenue with total ad spend on a weekly basis. ROAS cannot be an absolute growth indicator, and whether it's high or low, exceeding the minimum ROAS that generates profit is what's important. After the accuracy of conversion data declined, we've returned to the classic way of evaluating ad spend results.

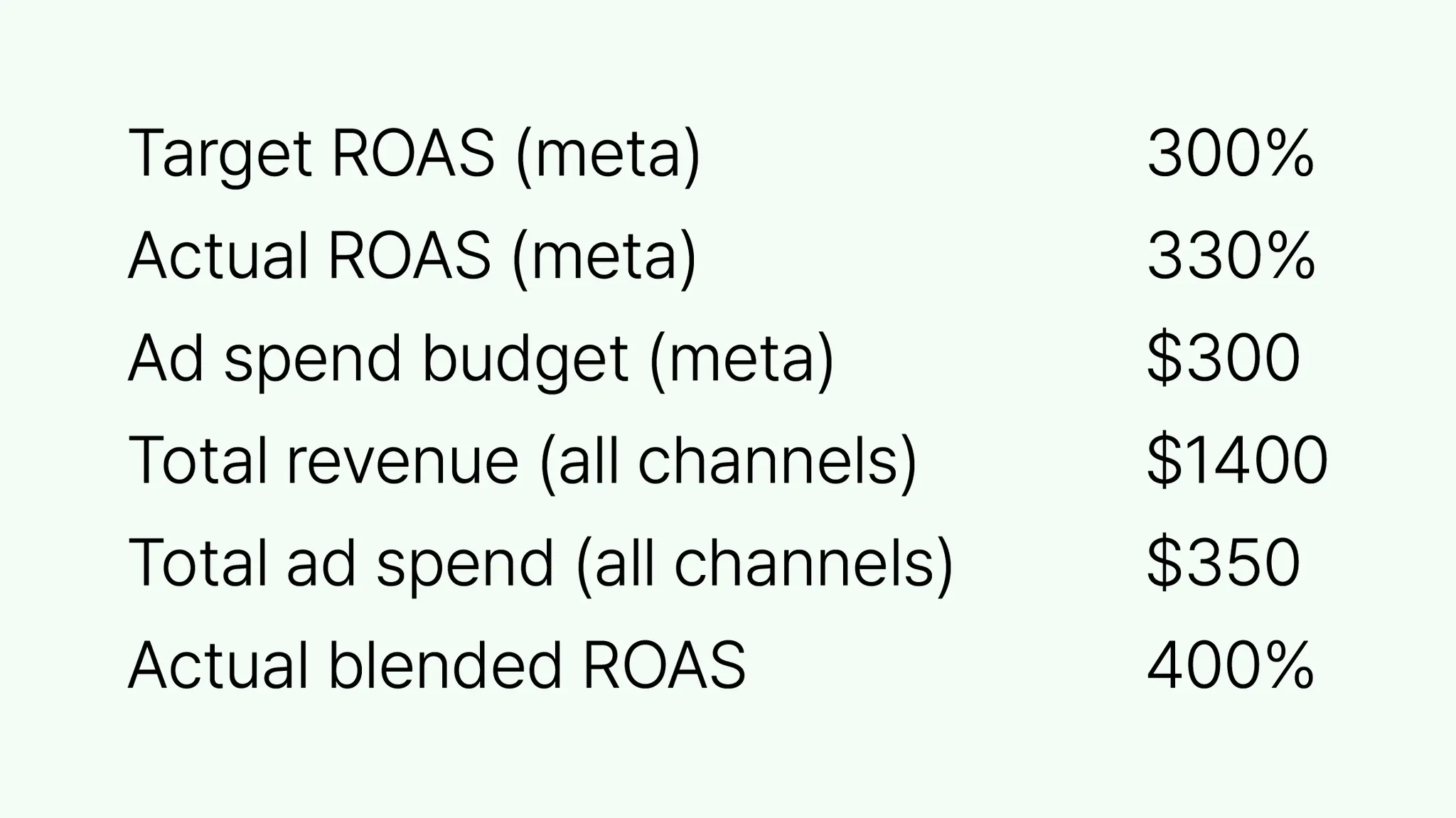

ROAS & blended ROAS when ad spend is $300

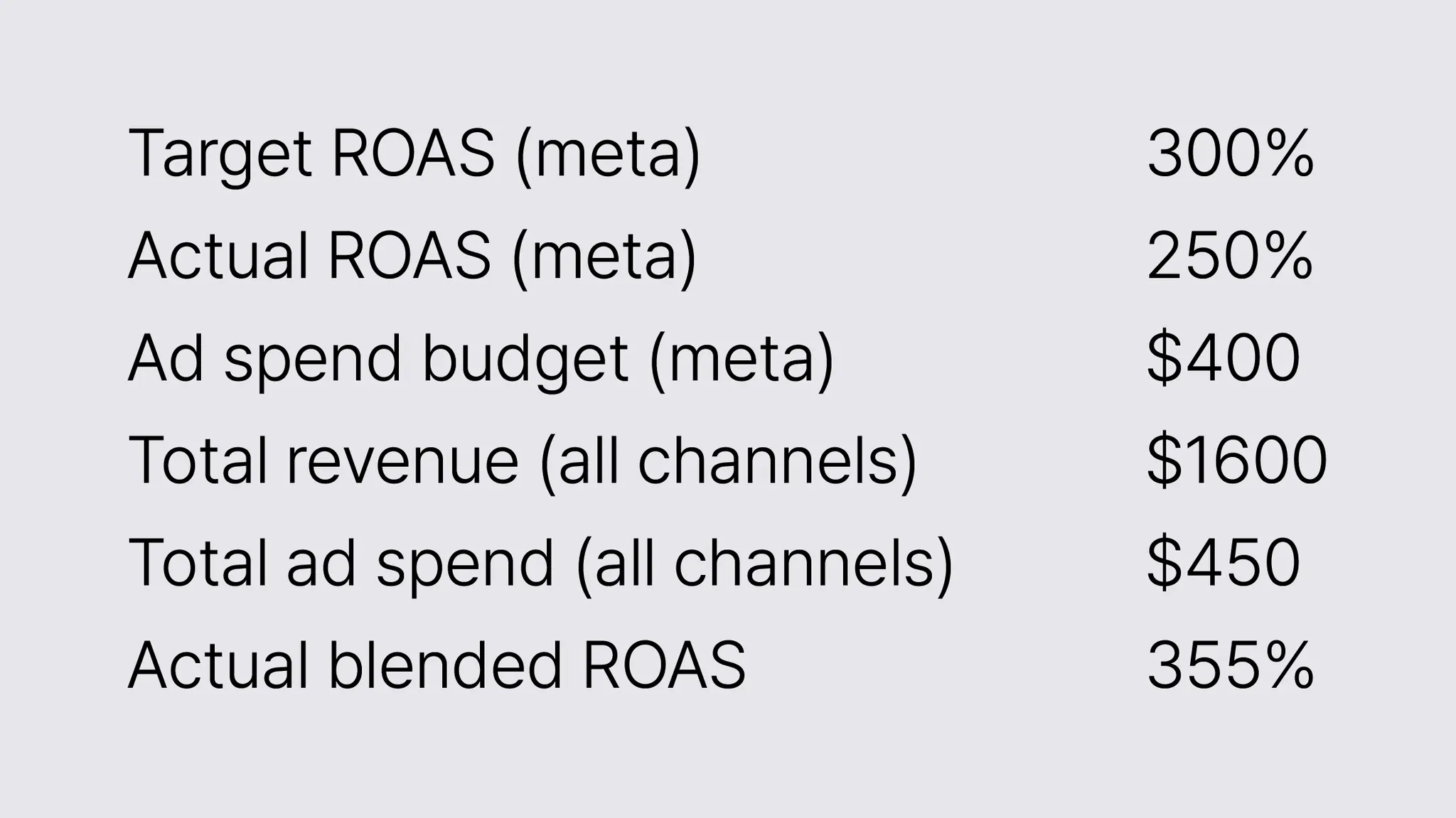

ROAS & blended ROAS when ad spend is $400

Let's consider an example. The above shows the changes in ROAS and total revenue when the ad spend budget increases. Suppose a marketer allocates $100 more to ad spend in meta. After adding $100 more, the ROAS decreases to 250% in meta. Assuming that the marketer is investing the budget only in meta and SEA, what action should the marketer take?

If you only consider the ROAS at meta, it decreases to 250%, but the total revenue tells a different story. In terms of gross profit, it's a positive result. We can expect that various traffic not accounted for by meta has led to an increase in profit. From the blended ROAS perspective, you are earning more profit with increased ad spend, so you might want to allocate more resources to meta. However, if the marketer does not give this much thought, they might simply reduce the budget.

"Then why is there a mismatch in conversion data?"

This may be due to untraceable conversions after the iOS update and organic sales caused by traffic from multiple touchpoints leading to purchase. More valuable decisions could be made using blended ROAS and profit, instead of focusing solely on the ROAS target of individual channels. After making decisions based on the blended ROAS continuously, you'll start considering the effect of ads across channels and evaluating whether the marketing plan was appropriate or not.

Achieving Growth Using Multi-channel Strategy

Achieving Growth Using Multi-channel Strategy

In the above example, we've limited the ad channels to meta and SEA, but using three to four channels is average. Channels include brand websites, Coupang, Naver Smartstore, etc. At Boosters, we regard blended ROAS as one of the key performance indices to evaluate our brand's status.

Rather than relying on a single channel, we distribute our resources to different channels for the brand to show steady growth. Boosters also focus on building a strong channel portfolio by launching our brands across various retail channels, while strengthening the DTC business as well. It's risky to expect continuous growth from a single channel, where the cost of paid ads and CPP (Cost Per Purchase) is already high. Back in 2019, when CPP was relatively much lower than the product's selling price, DTC was deemed the most effective and efficient strategy. However, it now seems nonsensical to solely rely on DTC, considering that South Korea has such a large ecommerce market.

Characteristics of Retail Channel : (1) High Contribution Margin Rate

Characteristics of Retail Channel : (1) High Contribution Margin Rate

What differentiates online retail channels such as Coupang and Naver Smartstores from a brand's website is the cost structure and the trickle-down effect from heavy traffic. In DTC, the biggest cost next to production is marketing (mainly advertisements). The more unknown an item is, the more advertising costs it will require to secure users. This is why ad spend is usually the highest among other costs in a DTC business.

However, retail channels do not need to spend as much on ads compared to a brand's website. Instead, they have selling fees for every item sold. Selling fees vary from 8 to 11 percent and sometimes between 30 to 50 percent.

So, which of the channel's margin rates (return on ad spend) do you think is higher? Usually, if the ROAS is not as high as over 500%, the retail channel has a higher margin rate. Due to the rise in ad spend (due to low ad efficiency) in recent years, selling fees in retail channels feel relatively cheaper.

Let's suppose we're selling a product with a production cost of more than 25% of revenue. If the ROAS is 250%, the return on ad spend would not go over 30%. However, if you make a nice channel portfolio, generating continuous traffic across channels, the return on ad spend may exceed 40%.

Characteristics of Retail Channel : (2) Display Effect

Characteristics of Retail Channel : (2) Display Effect

Though it's common now, online courses teaching how to register products in Naver Smartstores and generate sales with minimal investment were popular three years ago. Small businesses in Naver Smartstore were able to thrive due to the enormous traffic on Naver.

While the way algorithms are used to drive impressions is constantly changing, the power of retail channels remains the same. If you can get your product on the top list of a particular channel, you won't have to spend much on advertising as the list itself serves as the advertisement. Also, you can expect sales from promotions by the channel’s merchandiser. It’s important for brands to launch their products in different channels at the right time to gain such an advantage.

If you have a network with the merchandise or the power to get the upper hand in negotiations and enough inventory to fulfill a large demand for product volume for traditional retailing stores, it’s best to match the timing of the brand launch on your website with other channels.

Back in the days when the e-commerce industry was centered around DTC-oriented brands, the dominant idea was, ‘Why sell at retail channels while paying expensive channel fees, when you can get 400-500% ROAS on your own website?’ Also, many thought a brand website was better in terms of the number of potential users who consume advertisements and flexibility in increasing the ad budget. Yet, retail channels weren’t completely out of the picture. The ads on brand websites sometimes led to unexpected revenue in other channels.

However, brands that missed the right timing had to face the consequences of rejections to offers made by certain channels in the early stage. Also, there was no guarantee that they would succeed once they got in because it takes time to be noticed.

Branden’s Multi-channel Strategy

Branden’s Multi-channel Strategy

A great example of a brand that has achieved tremendous growth through a multichannel strategy is Branden, Boosters' core portfolio brand, which offers travel essentials. Branden continuously offers various travel items in addition to the Compression Pouch, Branden's flagship product.

When we acquired the brand, we noticed a direct correlation between ad spend and the search volume for "compression pouch". This seemed unusual, so we aggressively ran advertisements to maximize our impressions while concurrently launching the brand on other channels. At that time, the monthly search volume for "compression pouch" was under 1,000. (now much higher)

Increase in search volume of “compression pouch”

We began selling Branden's products on Coupang in the summer of 2022 and saw promising results from the start. As COVID-19 shifted to an 'endemic' stage and travel demand started to rebound, we ramped up brand advertising and noticed revenue growth from various channels. To achieve higher rankings across these channels, we implemented strategies like product trial groups and live commerce. These strategies effectively boosted our sales volume and review count, thereby diversifying our revenue portfolio and distributing risk. If Meta were to unexpectedly cease selling targeted ad products, the impact on Branden's sales would be less severe than anticipated. This is due to the organic sales generated from retail channels with substantial traffic.

Branden's Blended ROAS has improved considerably compared to when we only had one store (prior to acquisition). Still, it's unclear if there was a significant drop in our main channel's revenue. It appears there wasn't significant cannibalization. As the target market expands, channels should diversify to provide easier access and convenience to various consumers, maximizing advertisement effects.

Using blended ROAS as a KPI encourages marketers to think from a broader perspective. The outcomes depend on the roles leaders assign to their brand's primary sales channels and how they communicate their objectives to the team. Typically, each channel has different KPIs, which can make it challenging to promote cooperation over competition.

While it may not be applicable in all instances, the prospects of single-channel marketing and brand strategies may not be as promising as we'd like. Marketers might need to consider expanding their brands through multiple channels.